The question at the forefront of everyone’s mind right now seems to be: what do rising interest rates mean for me? Depending on whether you’re happy in your home with no plans to buy or sell; looking for a new home, but scared of rising rates; or contemplating selling your home, I have good news for you.

Buyers

Buyers

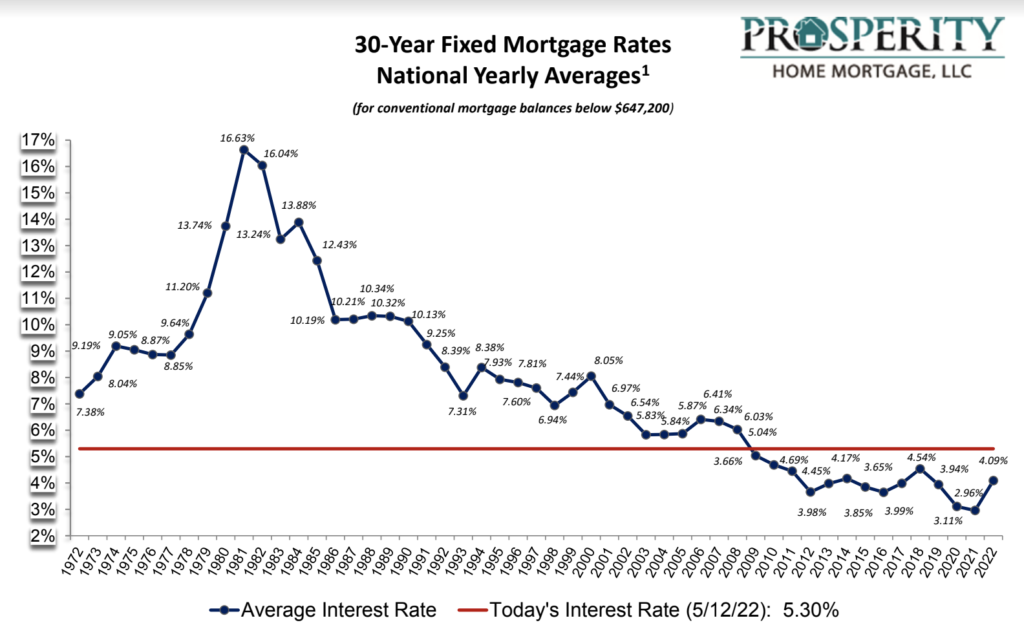

Many buyers are looking at the current interest rates and feeling sticker shock. We get it; 5% or more seems expensive compared with 2.3% just a year and a half ago! Still, it’s a great time to buy if you plan to be in your home for a while. Interest rates are only projected to rise and home prices have historically stayed the same or gone up in our region regardless of the economic climate. If you’re a buyer worried about rates, there are programs that allow you to lock your rate for 90 days while you’re shopping for a home, which can help you to stick to your budget.

One other important factor for first time buyers to consider is that mortgage rates aren’t the only thing increasing: so are rents. Renting is more expensive than it was a year ago, and at least you build equity with buying. In a time of high inflation, buying a home — and locking in today’s monthly payment for the next 30 years — is a good way to shield yourself from rising rents. Compared to an 8% annual inflation rate, a 5-6% mortgage interest rate suddenly looks like a good deal.

Sellers

Have you been considering a move? Don’t let interest rates stop you. Now is a GREAT time to sell your home. In the DMV, there are fewer homes on the market than there would normally be at this time of year, home pricing is the highest it’s ever been, and a ton of buyers are trying to purchase a home while interest rates remain reasonable. While increased mortgage rates could negatively affect housing prices, all signs point to BOTH figures continuing to rise. Alas, we do not have a crystal ball to predict exactly what will happen to prices in the future, but we do know what’s happening now, and with the inventory low and demand high, homes in our area are still selling at asking or higher to multiple strong offers.

Wondering what your home might sell for? Reach out to us for a no obligation estimate. (Don’t hesitate to task; we do this for neighbors, clients and friends all the time!)

Homeowners

Congratulations! Your home is worth more now than ever. With that said, there are a couple of things you can do now to fortify your home financially for the future. If you’ve been considering home renovations and have significant equity in your home, taking a Home Equity Line of Credit (HELOC) might make sense to do now – even if you don’t use it, just to know what the rate would be if you did decide to draw on that capital. You don’t have to make payments on the HELOC until you draw from it, so consider it a rainy day fund for your home.

The bottom line is: don’t despair! Whether you’re staying put or hoping to buy/sell, DC typically has a stable housing market even in economic downturns, and either way, we have partners who can walk you through various options, so if you have questions, reach out to any of us.