It’s been a record-breaking year for real estate in the DC metro area, with unprecedented buyer demand, minimal days on the market, and homes selling for well over asking price. Demand for housing in the DC area rose 63.5% in May 2021 compared to the same time last year (Bright MLS Home Demand Index).

As prices continue to rise and supply dwindles, I find myself being asked by friends, clients and even colleagues– “Is this a bubble? Is it going to burst?”

While I’m not an economist and I can’t predict the future, my professional take is no– we’re not in a bubble. Prices may plateau, but they’re just as likely to continue to rise. As Fortune magazine puts it, “No, we are not in another housing bubble.” Industry experts across the U.S. tend to agree– the factors fueling this housing boom are tangible, reliable, and not going away anytime soon.

Let’s dive into those factors as they relate to the DC metro area.

This isn’t 2008.

We all remember the foreclosure crisis of 2008 and the resulting Great Recession. Housing prices had reached a peak in 2007 and then plummeted the following year. A lot of people were burned in the crisis, so it’s understandable that people are wary of the spike in housing prices we’re seeing around the country again.

But there’s a key factor fueling the 2008 crisis that is not present today. Back then, lenders were allowing people to take out mortgages they couldn’t afford– even encouraging it. As a result, more people were buying expensive homes and prices inched up. The boom was artificial– based on access to capital that should not have been allowed. So when people couldn’t make their mortgage payments, the whole system toppled.

Call it the silver lining of the 2008 fiasco, but there are now laws in place to prevent predatory lending. You can’t just waltz into the bank and walk out with a hefty loan. When buyers today apply for a mortgage, lenders thoroughly review their financials to confirm the buyer can reasonably afford to make their monthly mortgage payment.

In fact, according to the Wall Street Journal, it’s actually pretty difficult to get a loan these days, with mortgages going “almost exclusively to borrowers with pristine credit histories.” Mortgage credit availability, a measure of lenders’ willingness to issue mortgages, is near its lowest level since 2014 (Mortgage Banker Association).

This means the high prices we see in the current market are based on real market demand. The buyers closing on homes can actually afford them and have decided the cost is worth it.

It’s Classic Supply and Demand.

Pricing is high right now because demand is outpacing supply. The inventory of homes available for sale has been low throughout the pandemic. There are lots of possible reasons for this.

First, it’s likely that the pandemic caused many would-be sellers not to put their homes on the market. The thought of strangers trekking through your home– or the process of buying and moving to a new home– at the height of COVID is unappealing to say the least.

Second, with prices as high as they are, many sellers are thinking “Great– I can sell my home for a ton of money, but then what? How do I buy a home at these prices?” Put yourself in the shoes of an older couple ready to downsize their large family home for a condo. If the condo ends up being nearly as much, they may decide to stay put for a few more years.

Finally, there’s been a huge increase in home repairs and remodeling during the pandemic. Houzz, an online home remodeling platform, reported a 58% annual increase in home projects leads in June 2020– particularly for outdoor spaces. Homeowners may be less likely to sell, having just invested time and money into making their home right for them.

Whatever the reason, inventory of homes for sale in 2020 and 2021 has been extremely low. At the same time, the number of buyers in the market appears to have been the same or greater than what it might normally be.

Buyers have also shifted their purchasing criteria as a result of the pandemic. For instance, many buyers are looking for extra space for a home office, outdoor space for socializing, mudrooms for decontamination, and less of an “open concept” to create private areas within the home.

In the DC metro region, there’s a much higher concentration of buyers looking for single family homes or row homes with 3+ bedrooms and a yard than we’ve seen in the past. With so many buyers and so few homes, people are willing to pay more to get what they want.

DC Has a Uniquely Protected Market

People don’t buy homes, jobs buy homes. In DC, there is always a steady job market due to the state and federal government. While the pandemic may have hit our restaurants and bars as in any other city, the wheels of government (believe it or not) kept on churning.

According to Clearance Jobs, “government employees lead the Washington, DC employment pool,” with a good chunk of other professionals falling into the Business and Finance, IT and Software, or Healthcare and Science categories.

What do these jobs have in common? (Well, depending who you ask). High compensation. The average total compensation in DC was $107,808 in 2020, compared to $88,915 for the rest of the U.S. (Clearance Jobs). And while I don’t have stats to back this up, a common phrase used around DC is a “DC Lifer” – someone whose career is so embedded in politics and government that they’re unlikely to leave, at least anytime soon. These well-heeled “lifers” tend to have the resources and the motivation to buy rather than rent.

It doesn’t look like our population is dwindling, either. A 2019 analysis by the Urban Institute estimates that 363,000 additional households will live in the DC area by 2030. Where are these people going to live? If you know the DMV, you know it’s already a pretty densely packed region. This is another reason we don’t see prices going down anytime soon. It all comes back to that classic supply and demand.

Granted, that survey was conducted pre-pandemic. Things can change. But as we’ve learned, DC has a uniquely protected job market and some seriously high-paying opportunities. We don’t see public interest in that dying down anytime soon.

Adjustments Can Happen.

Could there be an adjustment? Could we see pricing stop being so crazy or even go down?

Sure, if supply and demand change. If more homes start coming on the market, demand could be more evenly spaced out. In our region, that could mean going back to having 2-4 offers per house, rather than the 15+ offers we’ve been seeing lately.

In that case, we could probably expect to see less of those wild “$100K over listing” closing prices. We might also see more buyer-friendly terms come back into play, such as sellers entertaining home inspections and financing contingencies again.

It’s important to note– this doesn’t necessarily mean prices would go down. They just wouldn’t (in theory) be bringing in such unprecedented offers and competition.

Pressure on Pricing to Stay High

There are two important factors that will likely keep prices pretty stable.

First, when you get a loan to buy a home there is often an appraisal required by the mortgage lender. The lender hires a third party to go out, look at the home, and provide the lender with a report on their opinion of the value of the property. If the appraisal comes in at or over the contract price, the loan goes forward. If the appraisal comes in low, a negotiation may ensue.

When deciding a home’s value, appraisers typically use a minimum of three examples of similar homes that have sold within the last year. So what happens when all the other homes are sold for a high price? You got it– the home in question is more likely to be valued around that rate.

This keeps pricing high because loans continue to be approved at higher price points. And before you have flashbacks to 2008, consider what we learned above. You can’t just grab an easy loan these days– lenders are favoring those with great credit and sizeable down payment.

Second, unless a Seller is in financial duress or desperate to sell for personal reasons, Sellers typically don’t have to sell their homes. They can wait for a more favorable offer or environment.

Imagine you buy a home for $700K and want to sell it three years later, but the market value drops to $690K. If there’s no major rush, you may decide to wait until you can get a better return on your investment. In this way, Sellers themselves can fortify their property value and the property values in their neighborhoods.

The Trend is Up

Over the last hundred years or so the value of real estate in the U.S. has gone up… and up…. and up…. often outstripping inflation. Yes, there are corrections, but in general, real estate appears to be a fairly safe long-term investment. In fact, according to a 2019 Bankrate study, real estate was Americans’ favorite long-term investment in 2019.

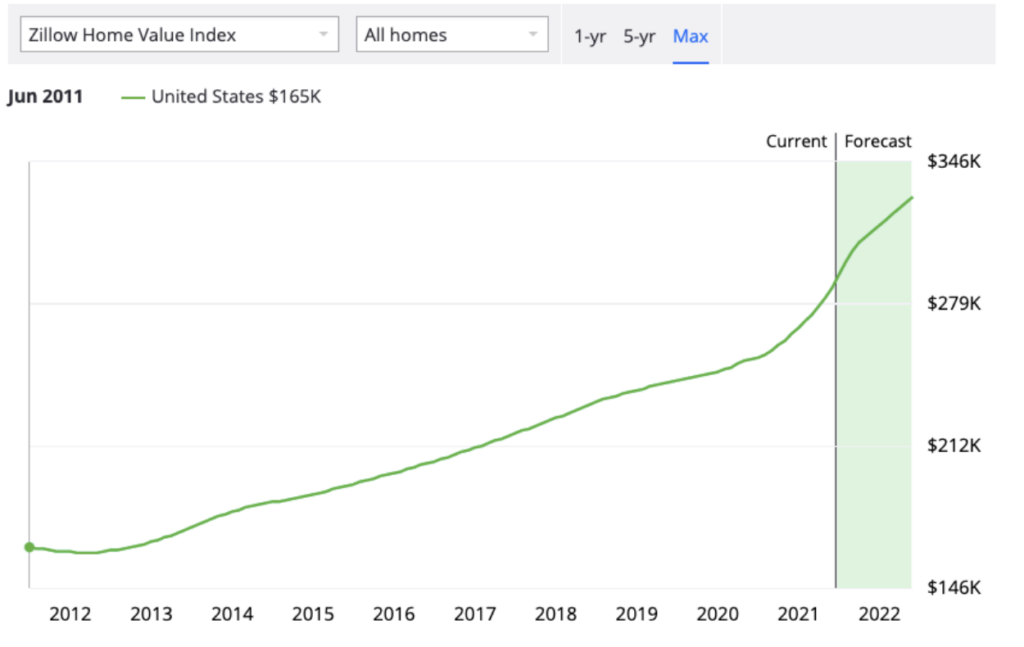

Reviewing the above Zillow Home Value Index, we see a near-steady rise in home values since 2012, when the market began to rebound from the recession. We already discussed the unique factors behind the 2008 collapse, but it’s encouraging to know that even that tumultuous period ultimately led to a healthy (if not thriving) decade-and-counting of increased value in real estate .$

Inflation Proof

Housing prices generally rise with inflation. There’s some simple logic behind this– if the cost of materials, labor, and everything else rises, so will the value of real estate. This tends to apply to both newly constructed properties and existing properties, as the latter benefit from the increased construction costs of new developments.

There are also more complex factors at play. One of them is interest rates, which tend to increase with inflation. As Mashvisor describes, “an economy that is experiencing rising prices is not conducive to getting favorable to loan terms. In fact, the cost of borrowing tends to be quite high in these situations.” This uptick in interest rates tends to increase the overall price of the property.

Concerns about affordability

You may be thinking “Great. We’re not in a bubble. Does that mean prices will just stay high?”

Probably– at least the DC metro area. We’re not exactly known as the country’s most affordable city. (In fact, in 2020 we were ranked the fourth most expensive city in the U.S.) The factors covered on this list– great job market, low supply, high demand, and high average salary– have a lot to do with that.

But don’t blame (or thank) the current housing boom for this new era. Housing affordability problems that already existed throughout the country have been massively exacerbated.

I was recently speaking with a friend’s mother who lives in rural Idaho. She mentioned that during the pandemic people from California who could work remotely started buying cabins near her for double and triple what they had been worth only a year before. As a result, there’s less housing for people who might staff restaurants or provide healthcare. This story has become increasingly common around the country and– as remote work becomes more commonplace– it doesn’t seem to be going anywhere anytime soon.

Here in the Washington area housing affordability has been an issue for a long time. While local political leaders are working to address the issue systemically, on a personal level, I’m always happy to talk with and educate anyone interested in getting into the housing market.